The Quarterly Q1 2025

Welcome to the second quarterly retrospective for The Budgeting App! In these posts, I’ll share a snapshot of what happened last quarter, reflect on our work and achievements, and outline our plans for the months ahead.

Part 1: The Numbers

I started writing this section by comparing last quarter’s stats to this quarter’s stats in detail. Honestly, it got boring quickly, and there’s more exciting stuff to share. So instead, here’s a quick overview of what changed:

Our active user base grew by 300%, reaching 33,000 users.

The rate at which we acquired new users increased by 300%. In the last quarter alone, we welcomed 26,000 new users.

Our core user group remains at about 10% of the active user base (3,500 users).

The number of paid subscriptions increased by 150%.

Our paid user conversion rate dropped by 20%.

The United States is now our largest user base, overtaking Australia. The top five countries (by user numbers) are the United States, Australia, Canada, the Philippines, and India.

Our top five countries by revenue are the United States, Australia, Canada, the United Kingdom, and New Zealand.

There are some great wins here, so let’s take a moment to celebrate…

Now, let’s dig deeper into the data so I can highlight one of the bigger challenges we’re facing.

Part 1.1: We’re not Sticky Enough

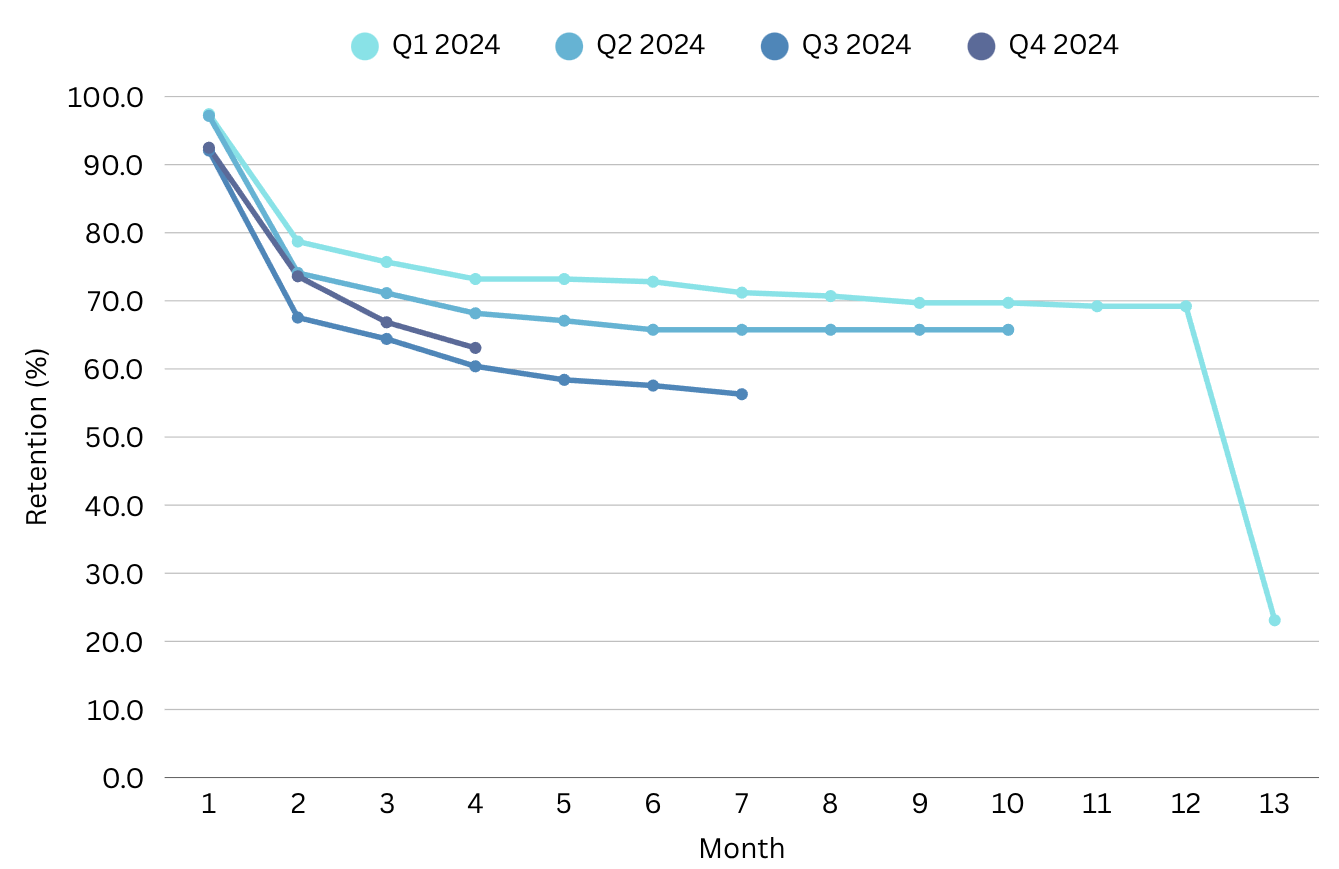

Let’s talk about retention. The graph below shows our paid user retention rates grouped by quarterly cohorts.

From this information, we can see three key insights:

Retention plateaus: Our retention appears to level off around 60–70%.

Quarterly trends: Retention dropped from Q1 to Q3, then recovered slightly in Q4.

Sharp drop-offs: There’s a significant decline in retention from month 1 to 2, and an even steeper decline from month 12 to 13.

Regarding the Q1 to Q3 dip, I suspect it’s due to how we approached development. During this period Natalie and I worked other jobs full-time, shipping features willy-nilly without a clear strategy. Q4 was the first time we started taking the app’s direction seriously. It’s too early to tell if our efforts in Q4 2024 and Q1 2025 have had a big impact on retention—time (and more data) will tell.

The steep drop-offs are easier to understand when we break retention down by monthly vs. yearly subscribers:

Looking at monthly subscriber data, across all cohorts, about 60% of users churn after the first month and around 70% after the second month.

Looking at yearly subscriber data, by the start of the second year, 70% of Q1 2024 subscribers had churned.

So why are people leaving?

Cancellation survey results suggest two main reasons:

People have given up on budgeting.

A competitor is doing something better.

These findings align with the data: 28% of users aren’t using the app enough, and 15% have switched to another product. Moreover, 42.2% of our users have told us they want more encouragement and accountability to achieve their financial goals.

Clearly, improving user stickiness will be a key objective for us in 2025.

Part 2: Highlights from Last Quarter

Here’s a quick look at the major updates we rolled out over the last quarter, and what we learned along the way.

Part 2.1: Money Manager

Our main focus in Q1 2025 was restructuring how accounts work in the app. This was vital to enable open banking (linking your bank accounts) and to meet customer requests for managing multiple accounts under a single budget.

We rolled out the update at the beginning of March. Here’s the breakdown of which “book” types people currently use:

Expense Tracker - 48.7%

Simple Budget - 41.0%

Money Manager - 12.8%

We only expected people with more than one year of budgeting experience to use Money Manager for tracking and reconciling their real-life accounts. The survey below helps show if these numbers make sense:

“How long have you been budgeting?”

0-6 months - 74.2%

6-12 months - 9.6%

1-3 years - 7.5%

3-5 years - 1.5%

5+ years - 7.2%

It seems people new to budgeting (0–12 months) lean towards Expense Tracker or Simple Budget, while those with more than a year of experience are using Money Manager. This isn’t enough proof that Money Manager is crushing it, but it’s a good sign that users are finding real value there.

Part 2.2: Anonymous User Subscription Flow

While sifting through Google Analytics, we noticed something interesting. We let people use our app anonymously (no email required) to lower onboarding friction. However, we didn’t think through what would happen if an anonymous user tried to subscribe.

Originally, whenever an anonymous user selected a payment plan (monthly or yearly), they were prompted to register. The data showed that 58.2% of users who tapped a plan were anonymous and saw the registration pop-up, but only 15.7% of those users went on to subscribe.

We tested subscribing users without making them register first—and it worked. We then updated the flow so users can subscribe anonymously, and only after subscribing are they nudged to register. They can still skip registering, but we remind them every 72 hours.

This small change made a big difference (so far). In our new subscription flow, 68.3% of users who tap a payment plan end up subscribing—compared to 38.5% with the old flow.

Part 2.3: Import CSV

This was a feature requested by a handful of users, but we kept it low priority because it’s a bit “advanced.” Exporting bank transactions, formatting them, then uploading them to our app doesn’t sound fun for most people. Still, we decided to implement it this quarter for three reasons:

Merging multiple books: We wanted experienced users to be able to combine multiple Expense Tracker or Simple Budget books into a single Money Manager book. We tried a built-in migration feature but couldn’t find a solution we liked, so Import CSV (paired with Export CSV) now lets them handle migration themselves.

New users switching over: People using other budgeting apps wanted to switch to ours, but had no way to bring their data.

Open banking indicator: Anyone who’s willing to manually export, format, and import their data may pay for an automated process in the future.

We didn’t expect heavy usage, and the data confirms that: 2.1% of people who opened the app tapped the Import CSV button, and 9.9% of those actually uploaded a file. This low adoption rate matches our assumption that Import CSV would be a niche feature, primarily used by power users.

Part 3: Coming Up in Q2 2025

Our main focus for 2025 is to improve user stickiness. From Part 1, we concluded people cancel for two reasons:

They’ve given up on budgeting.

A competitor is doing something better.

To address these issues, here’s what we have planned for Q2…

Savings and Debt Trackers

Right now, our app mainly focuses on short-term budgeting—keeping you mindful from one paycheck to the next. We don’t offer features to support long-term goals, which may cause users to lose sight of why they’re budgeting or fail to see their progress. Our new Savings and Debt Trackers aim to fix this by helping users work towards big-picture goals. This feature will get its own page in the bottom navigation bar and eventually become part of onboarding.

In addition to boosting retention by giving users a strong reason to keep budgeting, the data collected can also serve as a compelling marketing tool (e.g., “Our app has helped people save $100 million!”).

We have several data points supporting development of this feature:

Onboarding survey:

49.7% of users want help saving for something expensive (e.g. a house or holiday).

35.5% want help with financial independence or retirement.

33.4% want help paying off debts and loans.

Feature Requests: We’ve received multiple requests that this feature would address.

Login Streaks

This is a simple yet popular gamification mechanic. It encourages users to check in daily and stay on track. A basic version doesn’t take long to build, so this should be a quick win for us.

Open Banking

We’re finally starting work on open banking (linking bank accounts) this quarter. This fits nicely into our retention strategy as it tackles both reasons users churn:

Reducing effort: Automating data entry helps users stick with budgeting rather than give up.

Staying competitive: Other budgeting apps already offer this, so it keeps us in line with the market.

We ran an in-app survey to gauge interest in open banking…

“How interested are you in linking your bank account to automatically track your spending and income?”

Very interested - 25.7%

Interested - 16.0%

Unsure - 21.2%

Not really interested - 15.0%

Not interested at all - 22.1%

The results surprised us with their even distribution.

I’d like to know how many of those who are “unsure” or less interested feel that way due to privacy concerns, and how many prefer manual entry (a survey for another time, perhaps). Still, with over 40% of users interested (25% of them very interested), it’s enough to justify development.

Influencer Referral System

You’ve likely seen sponsored posts where an influencer offers a discount or free trial, and gets a cut of the revenue through a promo code. Although this doesn’t directly improve retention, it addresses the top of our sales funnel—bringing in new users. Right now, we rely heavily on organic growth, which is risky if an algorithm changes. An influencer referral system could help diversify our marketing, providing a steadier flow of new users.

We’re not certain this will be our best marketing option, but it’s worth testing. If the results show that influencer marketing is cost-effective and aligns well with our audience, it could become a key channel. If not, we’ll pivot and try other approaches. Building a reliable, scalable marketing engine is crucial for our app’s long-term success—retention alone won’t keep us afloat without a healthy influx of new users.

Thank you for joining our quarterly retro. We’re excited about these upcoming features and can’t wait to see how they help our users stay motivated, save more, and achieve their financial goals.

If you enjoyed this retro, feel free to share it and subscribe so you don’t miss the next one!